ALHC Profitability Inflection Point and Secular Tailwinds Could Lead to 2026 EPS of 0.70+

It all begins with an idea.

Overview:

Alignment Health is an emerging pure-play Medicare Advantage company that has proven its ability to manage high-risk to improve operating margin over the past 3 years.

Historical 40%+ year-over-year revenue growth is finally being accompanied by improving medical benefits ratio (MBR) and operating margin, with quarterly net income profitability on the horizon.

Assuming the company continues current growth trends and reaches an MBR of 87% in 2026, EPS could reach $0.70 or higher.

Introduction:

Alignment Health (ALHC) is a pure-play Medicare Advantage (MA) company which went public in 2021. The company’s business model is in its ability to manage high-risk members to reduce unnecessary hospitalizations and reduce medical expense costs. These savings are then passed on to patients through improved benefits as well as to shareholders.

To achieve this, Alignment Health utilizes a relatively high percentage of “shared risk” contracts. As context, Medicare Advantage companies typically use a combination of “global risk” and “partial” or “shared risk” agreements with healthcare providers. In global risk contracts, MA insurers pay a flat per-member-per-month (PMPM) fee for the services of hospitals, health systems, and independent physician associations (IPAs). In this model, the incentive is on the healthcare providers to cut costs and manage healthcare expenditures. In shared risk models, MA insurers pay a lower PMPM fee to healthcare providers, and in return they share responsibility to manage healthcare expenditures, and thus the profit or loss that comes with their ability to manage that risk. Because insurers like Alignment Health have more centralized insight into claims data such as medications dispensed, facilities utilized, and doctors visited, they are able to analyze that data to stratify members into different risk categories. CEO John Kao explains below from the 2023 Q4 transcript:

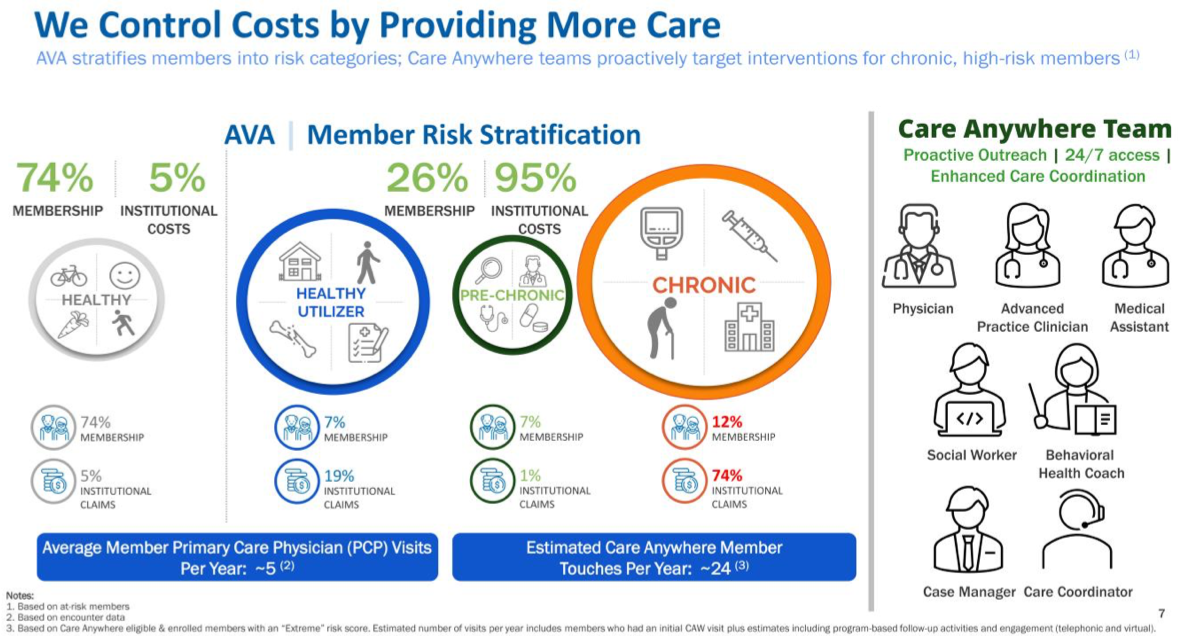

To further visualize this model, the figure below from shows that pre-chronic and chronic members are responsible for 19% of overall membership, and approximately 75% of the company’s medical expenses. These high-risk members are then eligible for the company’s Care Anywhere program, which employs a dedicated clinical team of doctors and ancillary staff which is accessible to the patient 24/7 for any urgent health concerns. If a patient who is considering going to the ER instead calls the Care Anywhere number, they could receive the necessary health advice or prescription medication immediately, and potentially save the company from unnecessary medical expenses.

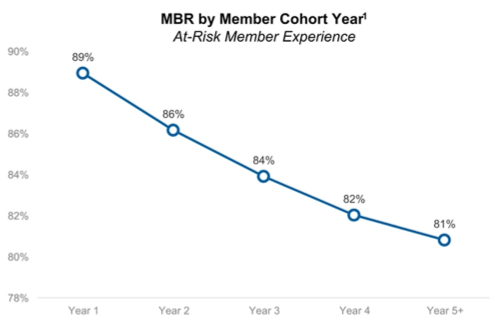

So is this model working? The company’s 2024 investor presentation shows that after the first four years of a member’s enrollment with Alignment, their medical expenses, or medical benefits ratio (MBR), drop significantly from 89% of revenue to 81% of revenue. Thus, as Alignment Health grows with new membership, it also becomes more efficient in managing its costs.

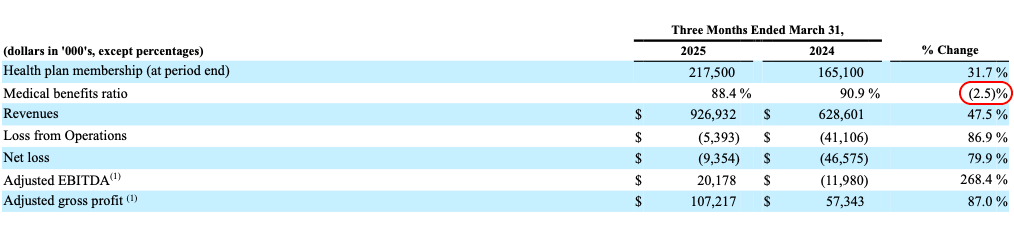

In my opinion, the first signs of MBR improvement impacting margins came in the 2024 Q1 results, which showed revenue growing at 43.1% while MBR increased by 1.2%. This is significant because in the prior year 2023, revenue only grew at 27.1%. Because the rate of revenue growth accelerated, 2024 showed a slight increase in MBR.

ALHC 2024 Q1 Report

However, the 2025 Q1 results now show that the revenue growth, although still strong at 40%+, has stopped significantly accelerating relative to 2024. As a result, MBR has improved by ~2.5%, as that large 2024 cohort’s MBR improved from their year 1 ratio of ~89% to their year 2 ratio of ~86%. In addition, this 2024 cohort should continue to provide margin tailwinds through 2028. If Alignment Health’s membership growth continues to stay in the 40s annually, similar MBR improvement should continue for several years for the 2025 cohort and so on until the terminal MBR rate of 81%.

ALHC 2025 Q1 Report

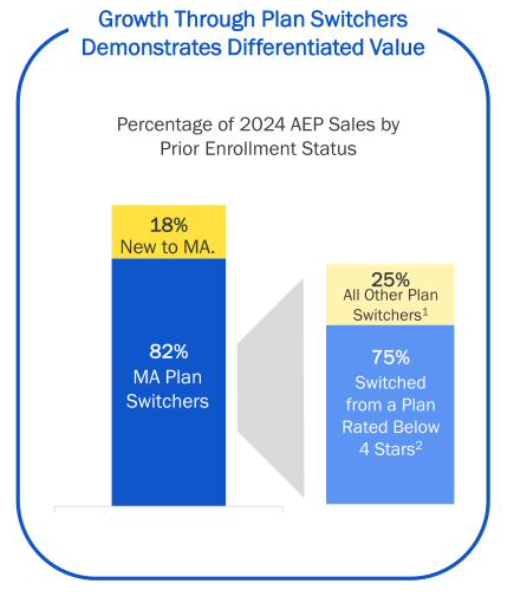

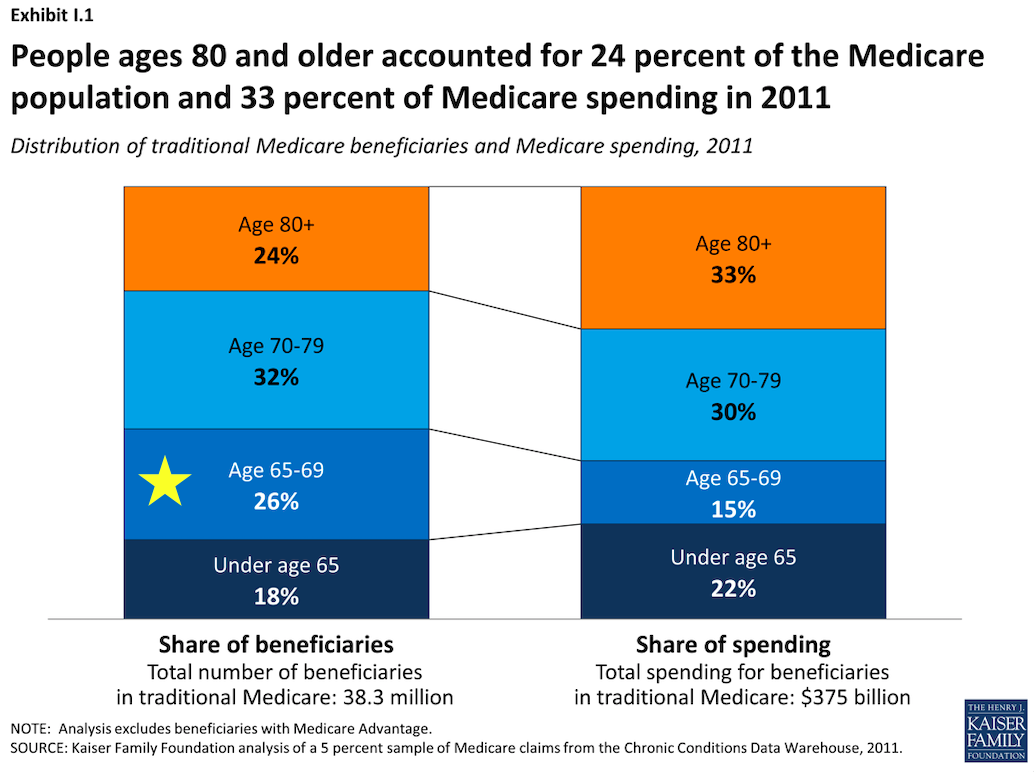

Other future MBR catalysts include demographic shifts in membership. As an emerging player in the MA space, Alignment currently relies on plan switchers, as both the consumer as well as medicare brokers may not be as familiar with the company as legacy names. Comparatively, current mature and dominant MA companies such as United Healthcare, Humana, and others generally receive most of their new membership from new MA enrollees (age 65).

ALHC 2024 Investor Presenttation

The reason why this is significant is because new-to-MA members at age 65 are relatively healthier than older plan-switchers, and a 2011 Kaiser Family Foundation report shows that this group effectively has a lower MBR compared to other age groups. Therefore as Alignment Health’s new members who are also new to MA increase from the current rate of 18%, this should be beneficial to gross profit margin.

Kaiser Family Foundation 2011 Analysis

Earnings

In 2025 Q1, analysts had a consensus earnings estimate of -$.13. Based on past earnings, this implies an MBR of ~90% and essentially assumes no improvement in MBR margins for 2025. The actual result of the earnings showed that revenue grew 47.5% year-over-year and MBR was 88.4%, almost 2.5% better than last year. Now in Q2, analysts are forecasting EPS of -$.07, again assuming an MBR of approximately 90%, with the improvement in EPS primarily being attributed to lower selling, general, and administrative costs (SG&A) as a percentage of revenue as the company has scaled.

If Alignment were to achieve the same MBR improvement in Q2 2025 over 2024 as it did in Q1, MBR would be 86.24% and EPS would be approximately +$.10. In addition, if this 2.5% MBR improvement is sustained through 2025, this would imply a 2025 full-year MBR of ~86.5%. For Medicare Advantage companies, health plans must maintain an MBR of at least 85% or face penalties from the Centers of Medicare and Medicaid Services (CMS). 2026 would then be a year of renewed focus on membership growth, as the lower MBR would give it more cushion to expand to new states and markets.

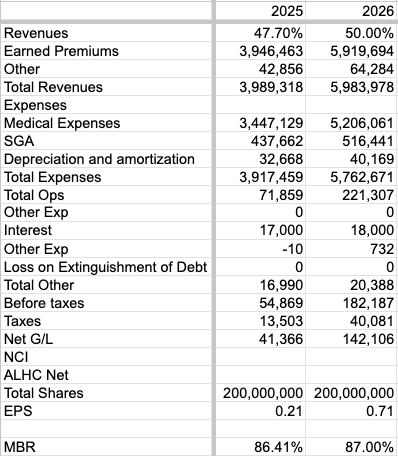

Fidelity Investments EPS Estimates

Assuming that 2025 revenue growth continues at the Q1 rate of 47.5% year-over-year and 2026 revenue improves slightly to 50% year-over-year, 2025 revenue would be approximately $4 billion dollars with an MBR of ~86.4%, and 2026 revenue would be approximately $6 billion with a slightly increased MBR of 87%. Assuming that SG&A operating leverage continues at current rates and grows 18% a year, Alignment could have a 2026 net income of $142 million and EPS of more than 70 cents a share. The risks of my thesis are if Alignment cannot execute on its clinical risk management as effectively as it has been doing, such as the inability of Care Anywhere to absorb the scale of new members joining the health plans. In addition, recent congressional investigations into billing practices and public scrutiny of Medicare Advantage overall contribute to slight policy risk of CMS adjusting reimbursement rates for the entire industry.

Below are my current projections for 2025 and 2026 Revenue and EPS.

CPAM July 2025 ALHC Projections

Conclusion:

Alignment Health is a rapidly expanding Medicare Advantage company focused on clinical risk management, demonstrating reliable results in its operating model and medical benefits ratio. The company is expected to post positive net income results in the near future and as early as this upcoming second quarter earnings release. Multiple catalysts in upcoming years include favorable demographic shifts in membership, as well as STARs ratings which are not discussed in this article. Profitability inflection could lead to a fundamental revaluation of the company. For example, assuming 2026 EPS of 0.71, a forward PE ratio of just 25 would imply a stock price of $17.75, and a forward PE ratio of 35 would imply a stock price of $24.85. My current price target for ALHC is $20 by year end 2025. Investors should conduct their personal due diligence and monitor upcoming earnings when they are projected to be released on July 30th.